Elites, Financial Networks, and Commitment in Dictatorships: Evidence from the Panama Papers

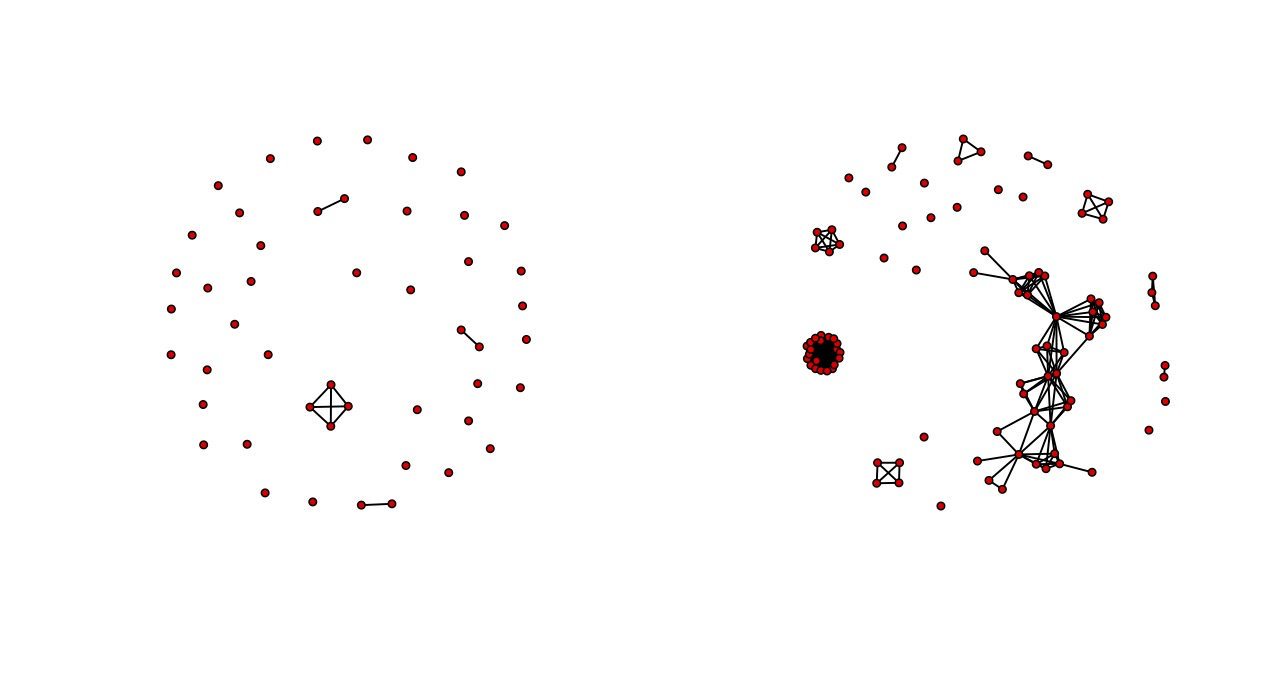

Abstract: A large literature argues that dictatorships can achieve high levels of economic growth if dictators can commit to not expropriate elites. Extant research has focused on the role of formal institutions—legislatures and parties—in helping elites constrain dictators’ predation. I complement this literature by documenting the role of an informal institution, elite financial networks, in constraining the dictator. I argue that dense financial ties among elites diffuse private information on the state of the economy, hence facilitating elites’ monitoring—if the dictator reneges on his commitments to elites, in- formed elites are able to infer and punish his defection. Accordingly, I hypothesize that dictatorships with denser elite financial networks enjoy stronger property rights. To test my argument, I uncover networks of elites’ co-ownership of offshore companies—a strong type of financial tie—using a large, untapped leak of private financial information, the Panama Papers. A thorough regression analysis of almost all dictatorships in the period 2002–2013 supports my theory: a one standard-deviation increase in financial network density predicts a half standard-deviation decrease in expropriation risk.

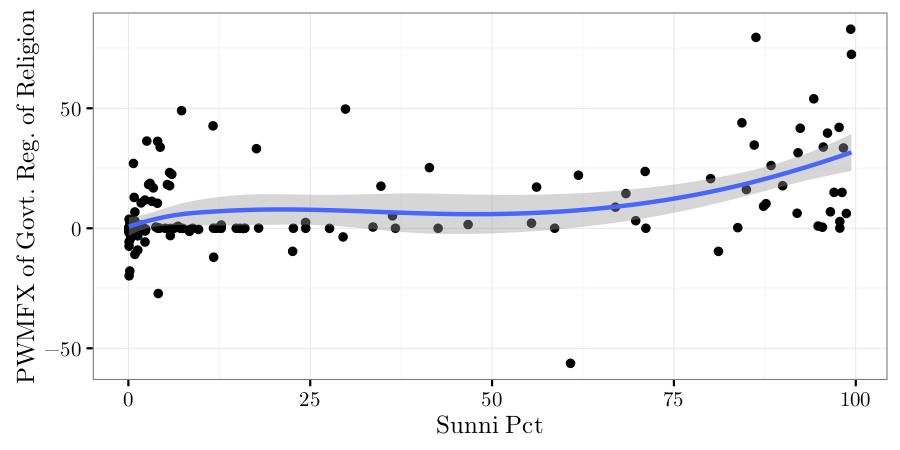

Predicting Foreign Fighter Flows to Syria Using Machine Learning: An Introduction to Kernel Regularized Hurdle Negative Binomial with Luke Sonnet

Abstract: Some countries have counted hundreds of their citizens fleeing to fight in Syria, while other countries’ citizens have remained bystanders? There are three methodological challenges to answering this question. First, there may be two groups of countries: one at no risk of ``supplying” foreign fighters and another supplying some positive amount. Second, there is no clear theory to specify the functional forms linking features to foreign fighter supply. Third, existing models perform poorly out of sample or yield output that is not amenable to social-scientific interpretations. To solve these challenges, we augment a hurdle negative binomial model with two machine learning tools. Namely, we allow our features to affect the response non-parametrically by using kernel functions that represent expansions of the data. Furthermore, we add regularization terms that penalize complexity to mitigate overfitting. Our approach combines the strengths of predictive and confirmatory models: it performs similarly to state-of-the-art machine learning algorithms in prediction while providing substantively interpretable output. Applying our model to data on 163 countries, we find that populous, developed countries, with a large Sunni population and proximity to Syria supply more fighters. These results lend themselves to viewing foreign fighter supply as largely driven by structural forces.

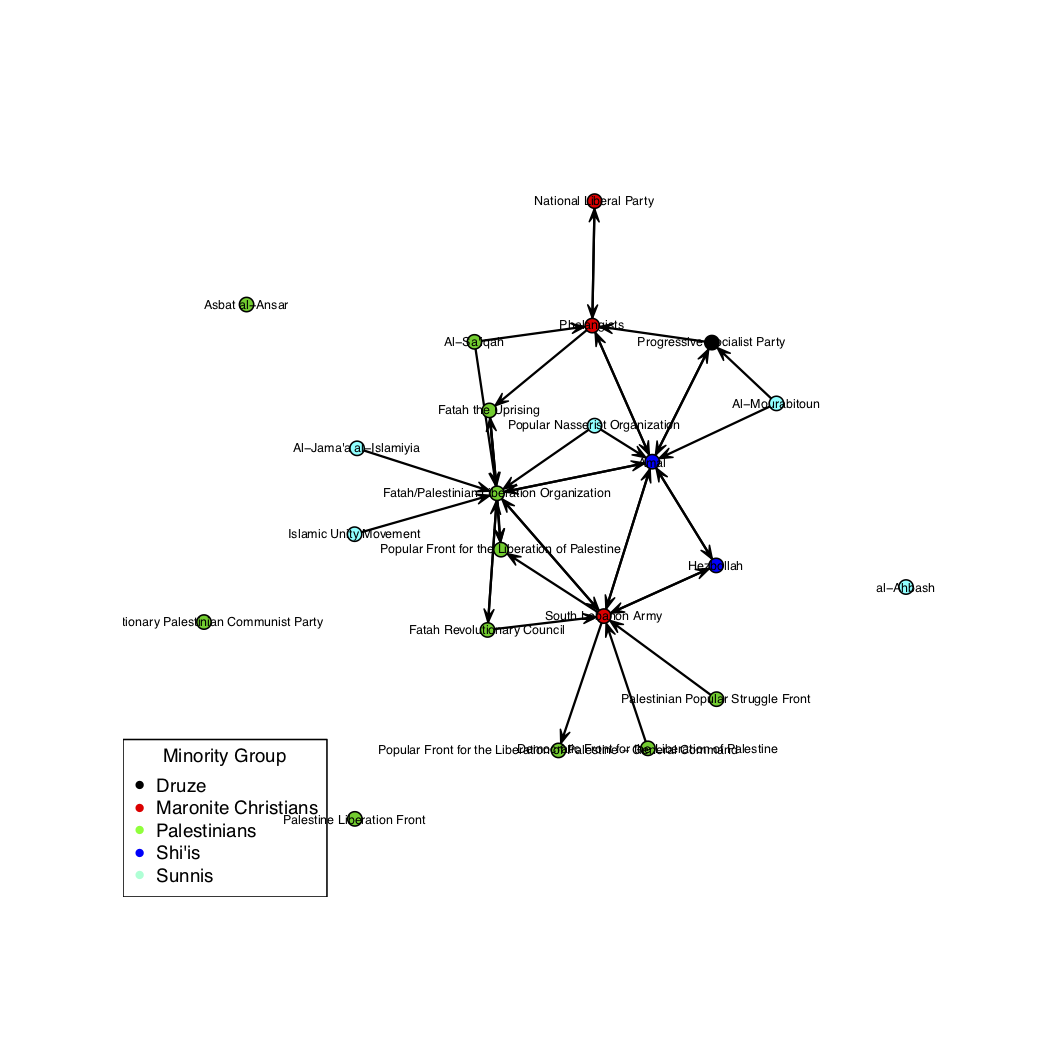

Modeling Inter-Rebel Group Conflict with Network Analysis: The Case of Lebanon’s Civil War

Abtract: The literature on civil war has recently shifted its attention from state-rebel violence to rebel-rebel violence. I build on this work by adopting an empirical, exploratory approach. Namely, I apply tools from Social Network Analysis to visualize, summarize, and model conflict between 22 rebel groups in Lebanon’s Civil War, specifically in the period 1980−1991. Using a network graph and node-, dyad-, and network-level statistics, I find a conflict structure in line with historical accounts: a dense pattern of hostilities, high reciprocity and low transitivity in hostilities, infighting within religious sects, and the existence of 3 central groups. Furthermore, using regression models tailored to network data (Exponential Random Graph Models), I find that groups that command support from the ethno-religious sect they belong to, control valuable natural resources and territory, and use terrorist tactics are more likely to attack other rebels, while groups that are able to reach an agreement with the state are less likely to attack other rebels. Finally, using a clustering model (Latent Position Cluster Model), I detect 2 sub-conflicts: a narrow cluster that includes the infighting among Palestinian groups and their Sunni allies and a broader cluster that includes the hostilities between rival Shi’ite groups. My approach is relevant to (inter)national policy-makers deciding which rebel groups to support, particularly in conflicts where opposition to the state is fragmented.

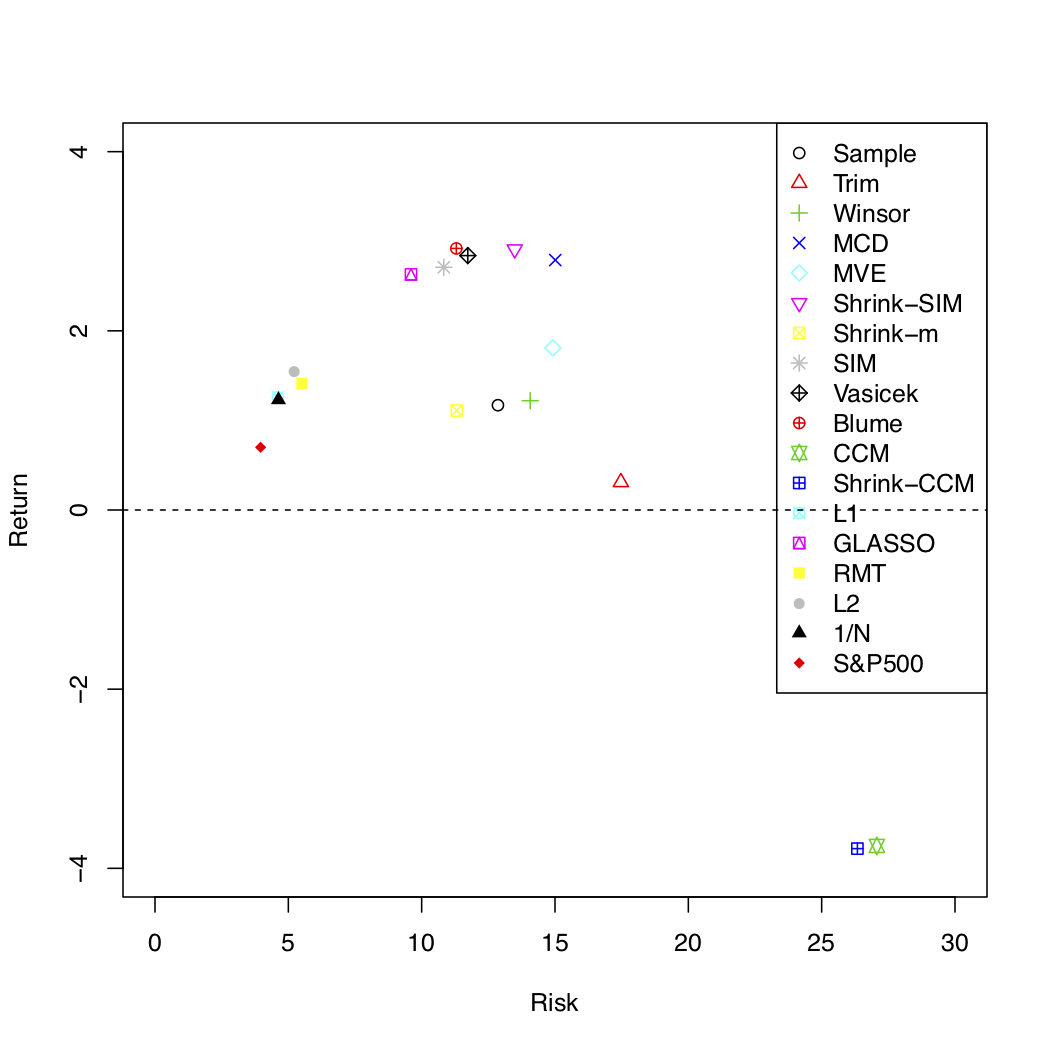

Optimal Financial Portfolio Selection

Abstract: Modern Portfolio Theory (MPT) has been the canonical theoretical model of portfolio selection for over 60 years, yet it faces limited adoption among practitioners. This is because MPT’s main inputs, assets’ expected returns and covariances, are estimated with noise, while the solution to its optimization problem requires the inversion of an ill-conditioned matrix. As a result, MPT often produces unstable portfolios with extreme weights. This study reviews and evaluates several methods for altering MPT’s inputs and optimization problem to produce more stable and diversified portfolios, without discarding MPT’s intuitive assumptions and structure. These methods are: robust estimators and shrinkage estimators of expected returns and covariances, covariances based on statistical models of returns, sparse graphical models of inverse covariance matrices, filtered covariance matrices, portfolio optimization that incorporates uncertainty in expected returns, and portfolio optimization with penalties on weights’ norm. To evaluate competing methods, I construct their respective portfolios using monthly data on 92 assets and 90 rolling training periods of 15-year length. Comparing these portfolios’ out-of-sample performance across several financial metrics and rolling test periods of 6-month length, I find that most alternatives outperform the standard MPT approach. However, I also find that only the L1-norm penalized portfolio marginally outperforms the benchmark equal-weighted portfolio, and owes its good performance to limiting short-sales.